Infrastructure is the physical systems – the roads, power transmission lines and towers, airports, dams, buses, subways, rail links, ports and bridges, power plants, water delivery systems, hospitals, sewage treatment, etc. – that are the building blocks, the Legos, that fuel a country’s, a city’s or a community’s economic, social and financial development.

There is an undeniable, an unarguable, connection between the quality of a country’s economic competitiveness and its infrastructure. Yet, study after study shows the global economy running an infrastructure deficit of anywhere from $40 trillion to $70 trillion.

Booz Allen Hamilton, in a 2007 report, estimated that investment needed to “modernize obsolescent systems and meet expanding demand” for infrastructure worldwide between 2005 and 2030 was around $41 trillion. And that is just for the US alone. Globally, these numbers are exponentially higher and the concern around the world has spurred movement to begin improving the global landscape.

Infrastructure spending geographically:

Middle East $0.9 trillion

Africa $1.1 trillion

US/Canada $6.5 trillion

South America/Latin America $7.4 trillion

Europe $9.1 trillion

Asia/Oceania $15.8 trillion

Infrastructure spending by sector:

Water and wastewater $22.6 trillion

Power $9.0 trillion

Road and rail $7.8 trillion

Airports/seaports $1.6 trillion

Canadian Imperial Bank of Commerce (CIBC) World Markets, in 2009, quoted estimates of up to $35 trillion in public works spending over the period from 2010-2030. The Organization for Economic Co-operation and Development (OECD) estimated total new spending over the next 20 years could be as high as $71 trillion.

Existing infrastructure is not only insufficient but outdated and unable to produce enough energy to satisfy the global demand. Developing countries represent a potential investment market since their demand for electricity is projected to grow 95% within the next 30 years. At the regional level, cumulative investment needs are largest in China ($3.6 trillion), European Union ($2.2 trillion), United States (2.1 trillion), India (1.6 trillion) and Southeast Asia ($1.0 trillion). By 2015, $26.1 billion will be invested in electricity (generation, as well as transmission and distribution), a rise of 18% above the $17.3 billion project to be invested region-wide in 2010.

Infrastructure Trends by Geography

The World Economic Forum’s Positive Infrastructure Report predicts that the world will face a global infrastructure deficit of $2 trillion per year over the next 20 years.

According to a prediction made by Norman Anderson, chief executive of Washington DC-based CG/LA Infrastructure, the OECD’s estimated $71 trillion necessary for infrastructure spending through 2030 is likely to be met with only $24 trillion spent by the world’s leading economies – a shortfall falling somewhere between $16 to $47 trillion.

Infrastructure, like everything, has a lifespan and simply put, infrastructure in many areas is simply too old.The challenge is exacerbated because we do not start with a blank sheet of paper. Cities have histories, cultures, dense populations, property rights, and deeply embedded political interrelationships that all demand respect. Past efforts to improve urban infrastructure have often led to disappointments. Not all projects have been equally deserving, not all forms of financing are equally advantageous, only some decision makers are sufficiently frugal and trustworthy, and wise judgment is not always applied in making and executing choices. Moreover, expertise cannot be applied the same way around the world: getting an infrastructure project approved requires an entirely different political process for the multiple competing authorities of metropolitan New York than for the hierarchical government of a Chinese city like Beijing.

Other concerns to global infrastructure improvements, include that of cost and fundamental logistics.

Key Problems and Impasses to Infrastructure Problems

But the cost of not meeting the challenge could be even greater than $40 trillion. The global economy is rooted in an urban lifestyle, which evolved with basic assumptions that millions of people take for granted. They can commute from work to home, and have access to light, heat, and water at the flick of a switch or a tap. Anyone who has lived without that access — for example, in Abidjan during its frequent blackouts, in Mumbai, where water supply is restricted to a few hours per day, or in New York in the days after the 9/11 attack when transportation came to a halt — knows how difficult it is to function without it. Moreover, the prime enabler of global trade is the increasingly complex, just-in-time, supply chain logistics system, which depends, in turn, on reliable power, mobility, and water.

A city’s ability to respond effectively to a crisis, such as pandemic disease or a terrorist attack, also depends on robust infrastructure: not just standard access to water, power, and mobility, but the extra capacity and backup needed for life under duress. In short, although the threats of global climate change and terrorist attack have occupied much of the industrialized world’s collective attention, inadequate and fragile urban infrastructure could well do more harm to a larger number of people.

First, the demand for essential infrastructure is exploding. The world’s population is projected to increase by one-third, to exceed 8 billion by 2050, with — for the first time in human history — more than 50 percent of humanity living in metropolitan areas. The requirements for water, power, and mobility will rise accordingly, even as population density makes it more difficult to build and protect the robust infrastructure needed to satisfy that demand (See Exhibit 2).

Global Electricity Consumption in relation to GDP

Global Efforts in Infrastructure Improvement

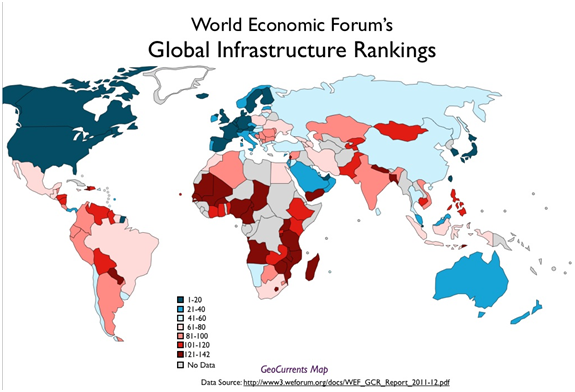

The issue of infrastructure improvement and sustainability reaches every corner of the globe and though each region, country, village and city have their own method for dealing with the concerns, the efforts to see stability across the aspects of transportation, energy consumption and land use is universal. A ranking of infrastructure from the World’s Economic Forum is here:

As older countries seek to catch up to newer ones, the issues plaguing our infrastructure is expanding. Each week, more than one million people are either born in or migrate to cities around the world. Much of this rapid urbanization comes from the emerging world, putting tremendous pressure on that country’s feeble infrastructure. Pipes burst, roads are jammed, the water is tainted and the lights even go out.

While each developing country could benefit from an upgrade, needs vary. This table details how different emerging market countries stand up against each other in terms of quality for the country’s roads, rails, ports, etc. The most improvements are necessary where countries rank in the bottom half among the 133 surveyed by the World Bank.

Quality of Infrastructure by Country

| U.S. | Germany | Brazil | Mexico | China | India | Russia | South Africa | Turkey | ||

| Quality of overall infrastructure | 89% | 95% | 26% | 43% | 56% | 32% | 41% | 65% | 47% | |

| Quality of roads | 92% | 96% | 17% | 50% | 62% | 35% | 22% | 70% | 59% | |

| Quality of railroad infrastructure | 87% | 96% | 35% | 46% | 79% | 84% | 76% | 72% | 48% | |

| Quality of electricity supply | 87% | 95% | 56% | 35% | 49% | 19% | 51% | 24% | 37% | |

| Telephone lines | 89% | 98% | 53% | 49% | 65% | 20% | 71% | 32% | 60% | |

| OVERALL | 94% | 99% | 41% | 49% | 65% | 46% | 56% | 64% | 50% |

100% is best, 1% is worst: Source: World Economic Forum, BofA Merrill Lynch Global Research

Conclusions and Projections

Global deficit hawks are driving forward with their austerity programs, as if they don’tunderstand that private firms, despite having piles of cash, will not let go of the purse strings if we fail to make adequate infrastructure investments.

Emerging markets are arising to invest in the coming years. Merrill Lynch estimates that $6 trillion will need to be spent by selected emerging market countries over the next three years to meet the basic needs of these citizens. Water, transportation, and energy investments will consume the bulk of these funds, accounting for 82 percent of total projected spending.

References

The Global Infrastructure Investment Deficit

http://aheadoftheherd.com/Newsletter/2012/The-Global-Infrastructure-Investment-Deficit.html

Lights! Water! Motion!

http://www.strategy-business.com/article/07104?pg=all

Problems with Global Infrastructure Rankings

Global Infrastructure a $6 Trillion Opportunity